|

Cash App ★ 4.6 |

|---|---|

| ⚙️Developer | Block, Inc. |

| ⬇️Downloads | 50,000,000+ |

| 📊Category | Finance |

| 🤖Tags | cash | banking | app |

Cash App is a mobile payment service that allows users to send, receive, and manage money conveniently from their smartphones. Developed by Square Inc., Cash App offers a user-friendly and intuitive platform for individuals to handle financial transactions effortlessly. With its secure and fast payment capabilities, Cash App has gained popularity as a convenient alternative to traditional banking methods.

With Cash App, users can link their bank accounts or debit cards to the app and perform various financial activities. These include sending money to friends and family, requesting payments, purchasing goods and services from participating merchants, and even investing in stocks and Bitcoin. With its straightforward interface and range of features, Cash App has become a go-to solution for many individuals seeking quick and hassle-free money transactions.

Features & Benefits

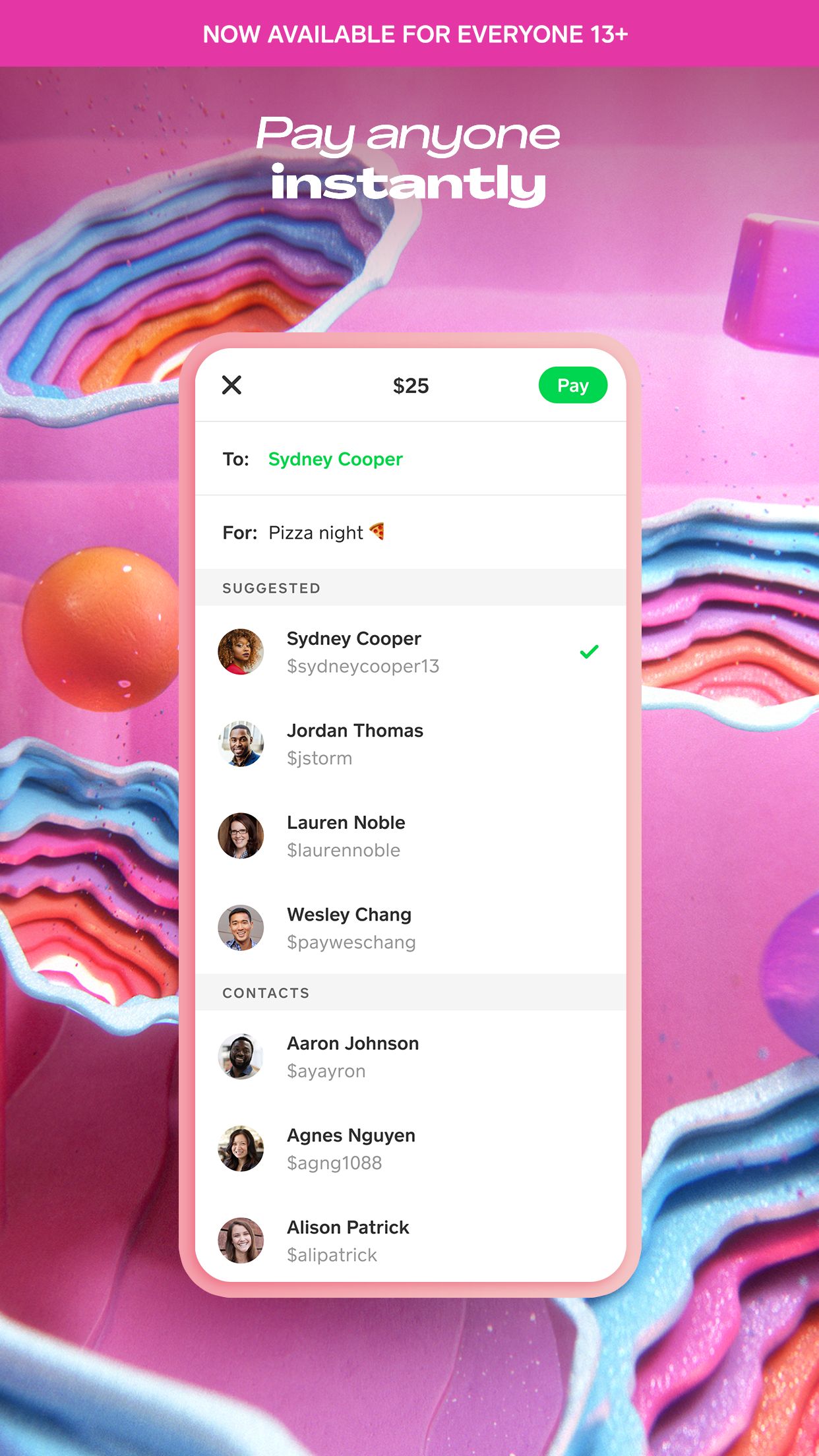

- Peer-to-Peer Payments: Cash App allows users to send and receive money from friends and family instantly. Whether it’s splitting the cost of dinner or paying back a loan, users can easily transfer funds with just a few taps on their mobile devices. The app eliminates the need for cash or checks, streamlining the payment process.

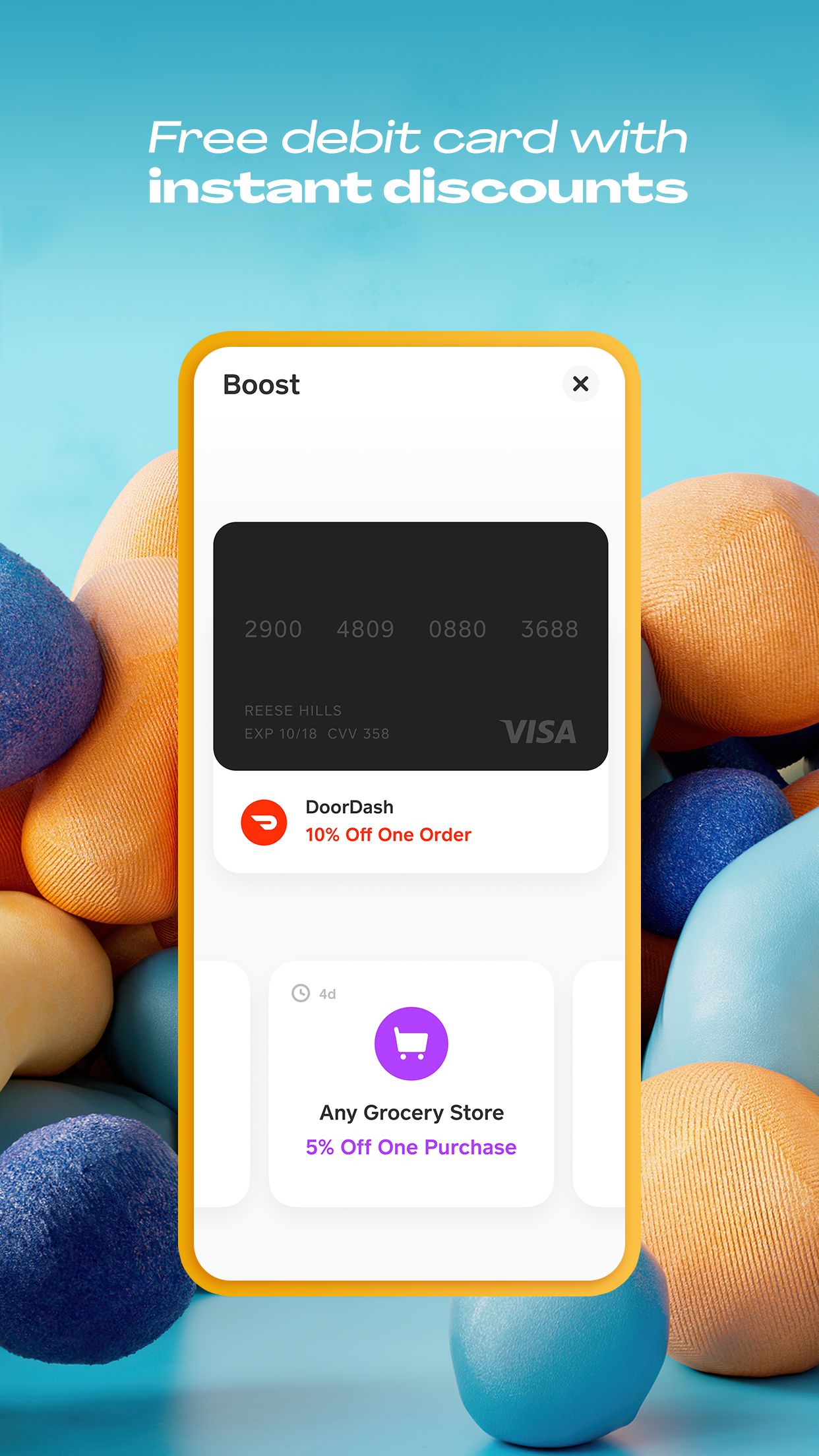

- Cash App Card: With the Cash App Card, users can enjoy the convenience of a physical debit card linked to their Cash App account. The card enables users to make purchases at any retail store or withdraw cash from ATMs. It provides a seamless integration between digital and physical transactions, giving users flexibility in managing their finances.

- Bitcoin Support: Cash App allows users to buy, sell, and hold Bitcoin directly within the app. This feature provides an accessible platform for users interested in cryptocurrency investments. Users can monitor the Bitcoin market, make transactions, and track their Bitcoin portfolio, all from the convenience of the Cash App app.

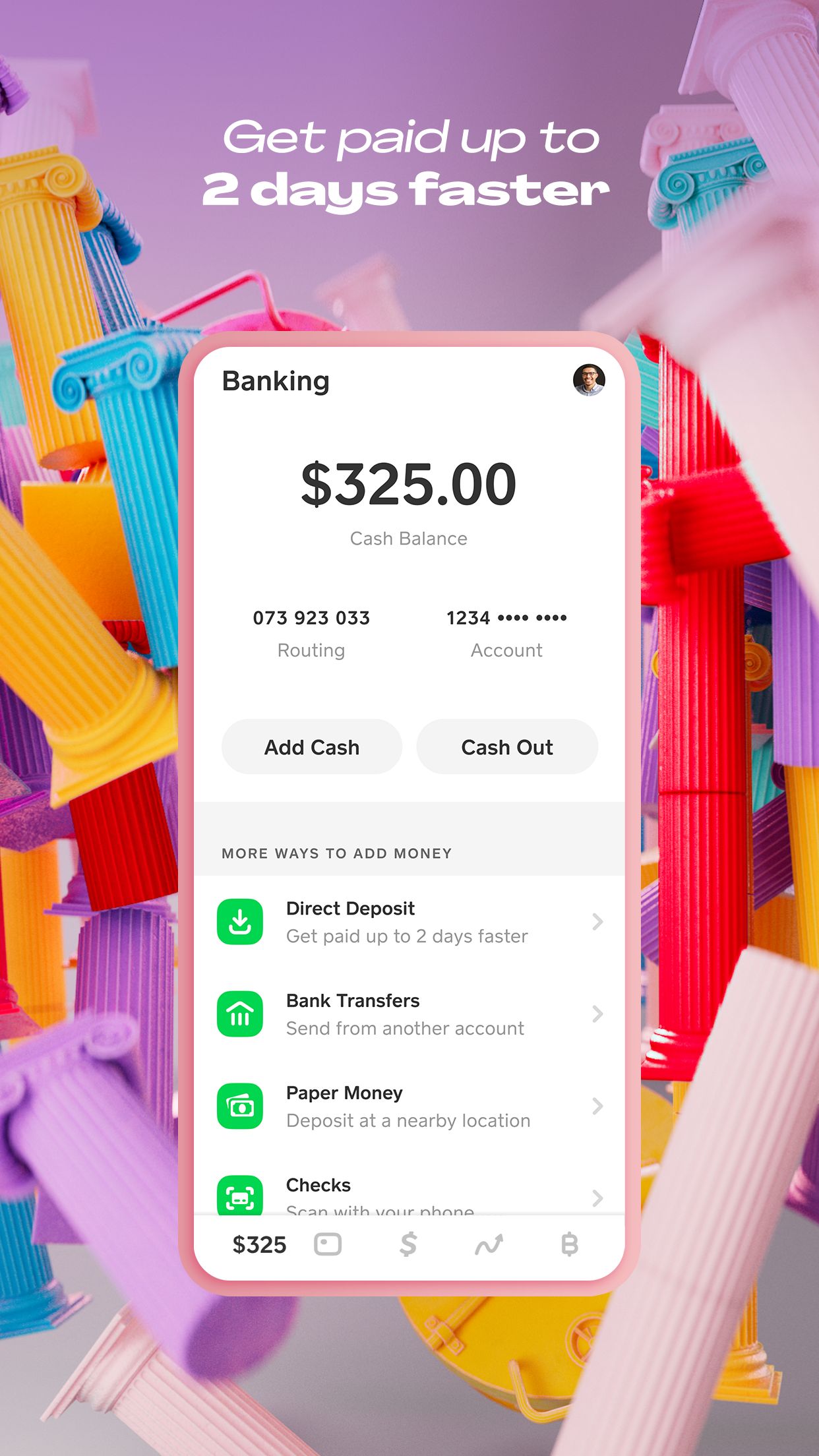

- Direct Deposit: Cash App offers users the ability to receive direct deposits of their paychecks, government benefits, and other regular payments. This feature eliminates the need for paper checks and enables users to access their funds quickly and securely, providing added convenience for managing personal finances.

- Boosts and Cash Back: Cash App provides users with the opportunity to earn cash back rewards and enjoy discounts on selected purchases through Boosts. Boosts are special offers and discounts available at various merchants, allowing users to save money on everyday expenses and maximize their spending power.

Pros & Cons

Cash App Faqs

The Cash App uses encryption and other security measures to protect user data and transactions. However, it’s important to enable additional security features like PIN codes and biometric authentication. The Cash App supports funding from debit cards, bank accounts, and Bitcoin wallets. Credit cards are not accepted. You can withdraw money from your Cash App balance to your linked bank account or debit card. Withdrawals typically take 1-3 business days to process. The Cash App has limits on the amounts you can send, receive, and withdraw per week and per month, depending on your account verification status. Yes, the Cash App supports direct deposit, allowing you to receive paychecks, government payments, and other regular deposits directly into your Cash App balance.How secure is the Cash App?

What payment methods can I use with the Cash App?

How do I withdraw money from the Cash App?

What are the Cash App’s limits on transactions?

Can I use the Cash App to receive my paycheck or government benefits?

Alternative Apps

PayPal: PayPal is a widely recognized digital wallet and payment service that enables users to send and receive money securely. It offers a range of features, including online payments and integration with e-commerce platforms.

Zelle: Zelle is a peer-to-peer payment service that allows users to send money directly from their bank accounts. It offers fast and secure transactions, often with instant transfer capabilities.

Google Pay: Google Pay is a mobile payment app that allows users to send money, make online and in-store payments, and manage loyalty cards. It integrates with Google services and offers a seamless user experience.

Apple Pay: Apple PayApple Pay is a mobile payment and digital wallet service offered by Apple. It allows users to make secure payments using their iPhone, iPad, Apple Watch, or Mac devices. Apple Pay supports contactless payments in stores, online purchases, and peer-to-peer money transfers.

Samsung Pay: Samsung Pay is a mobile payment service available on Samsung devices. It offers contactless payment capabilities using both NFC and Magnetic Secure Transmission (MST) technologies, allowing users to make payments at a wide range of terminals.

Screenshots

|

|

|

|